capital gains tax canada calculator

Illustration of long term capital gains tax in India Equity oriented mutual funds Long Term Capital Gains. And because tax rates are first applied to ordinary income long-term capital gains will not push your income into a higher tax bracket.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Any LTCG exceeding Rs 100000 arising on sale of equity-oriented mutual funds will be liable to tax 10 provided securities transaction tax has been paid on the purchase and sale.

. You can also calculate the capital using Scripboxs Capital Gain Calculator. Capital gains and your 401k or IRA One of the many advantages of making regular contributions to an employer-sponsored 401k or IRA is that the vast majority allow investors to buy and sell securities within the plan without having.

How To Calculate Capital Gains Tax H R Block

How To Calculate Rental Property Capital Gains Tax Cherry Chan Chartered Accountant Your Real Estate Accountant

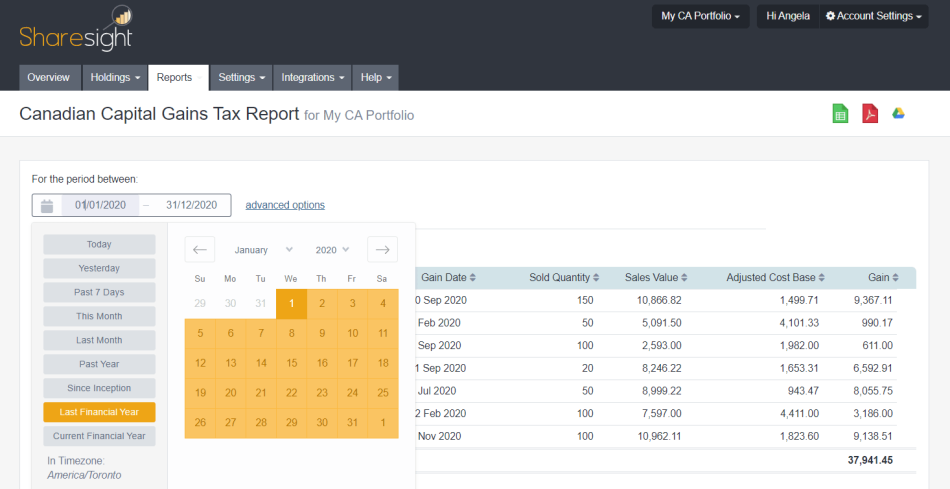

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight

Capital Gains Tax Calculator For Relative Value Investing

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

How Do I Calculate Capital Gains On The Sale Of My Home

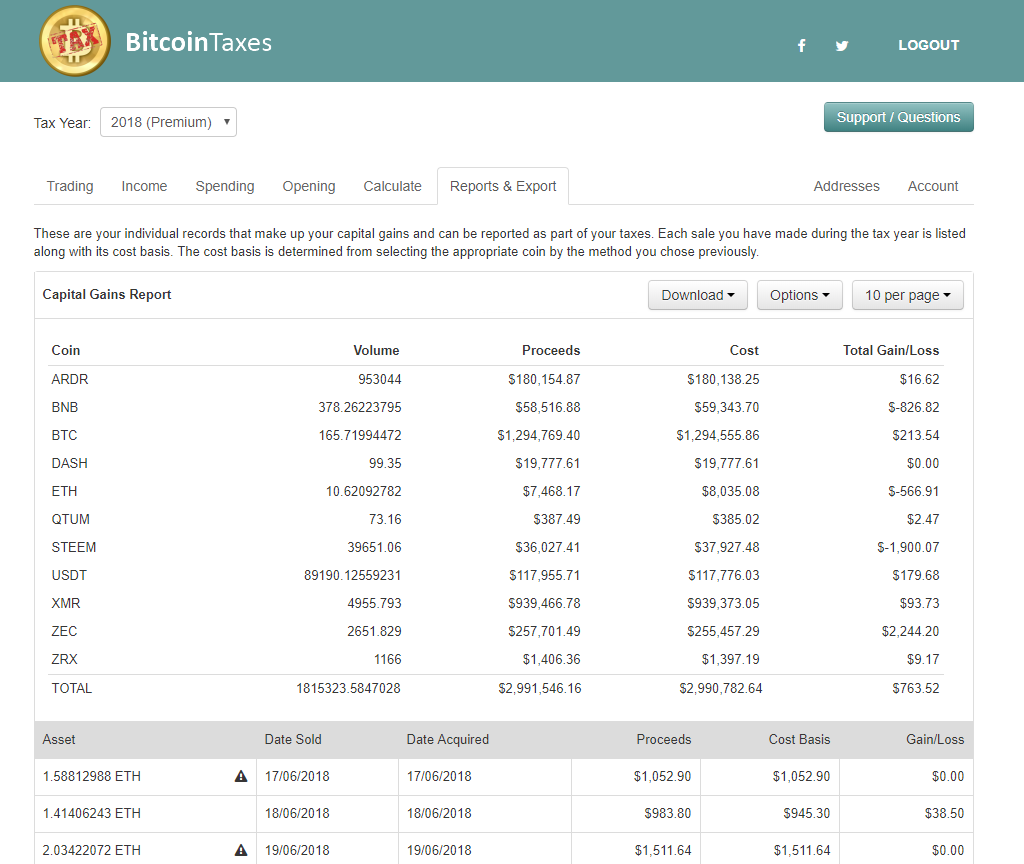

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Yield Cgy Formula Calculation Example And Guide

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Canadian Capital Gains Tax Report Makes Tax Time Easy Sharesight

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Income Types Not Subject To Social Security Tax Earn More Efficiently